Pacvue 2024 Q2 Retail Media Benchmark Report

Interactive Explorer

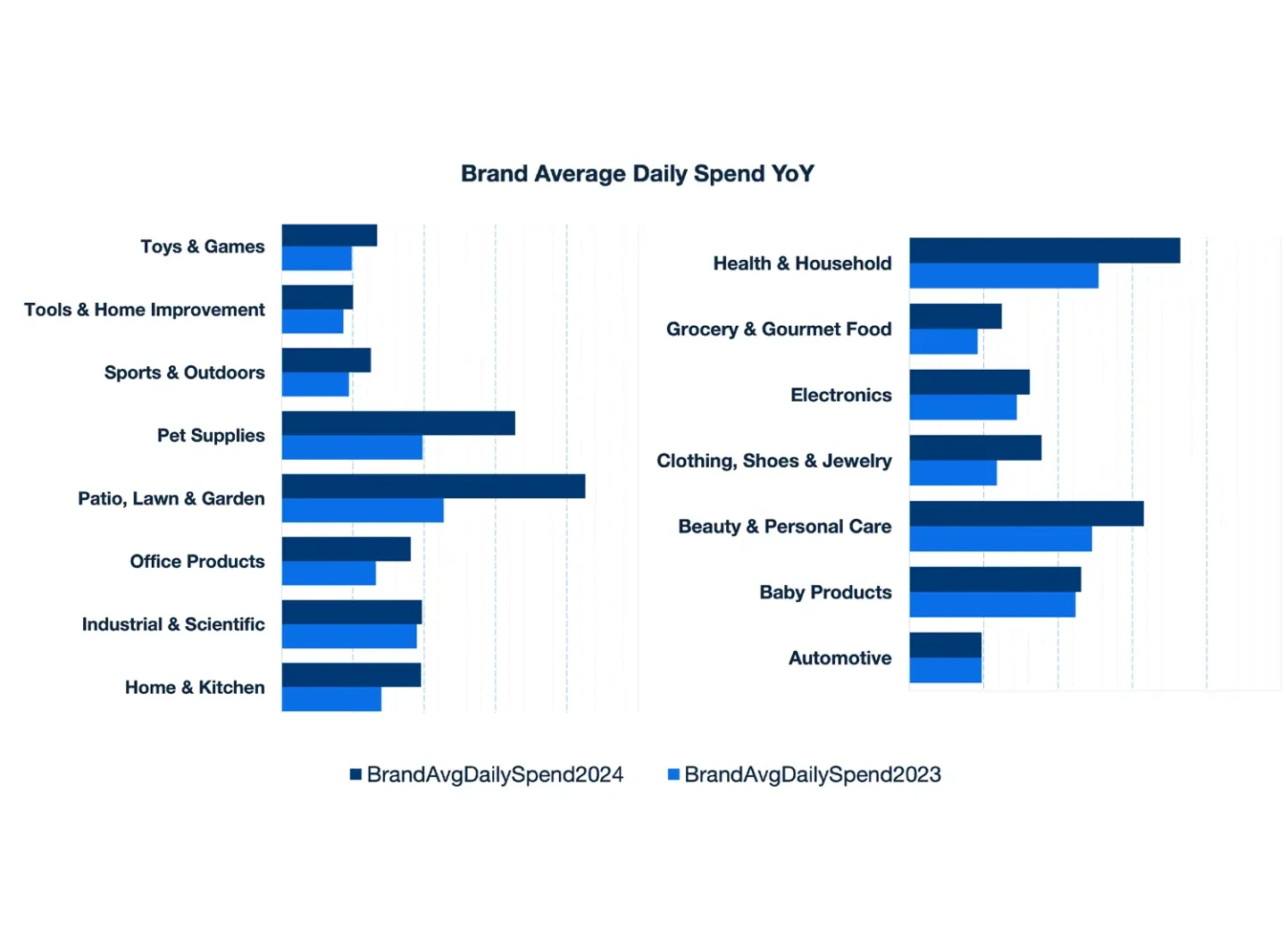

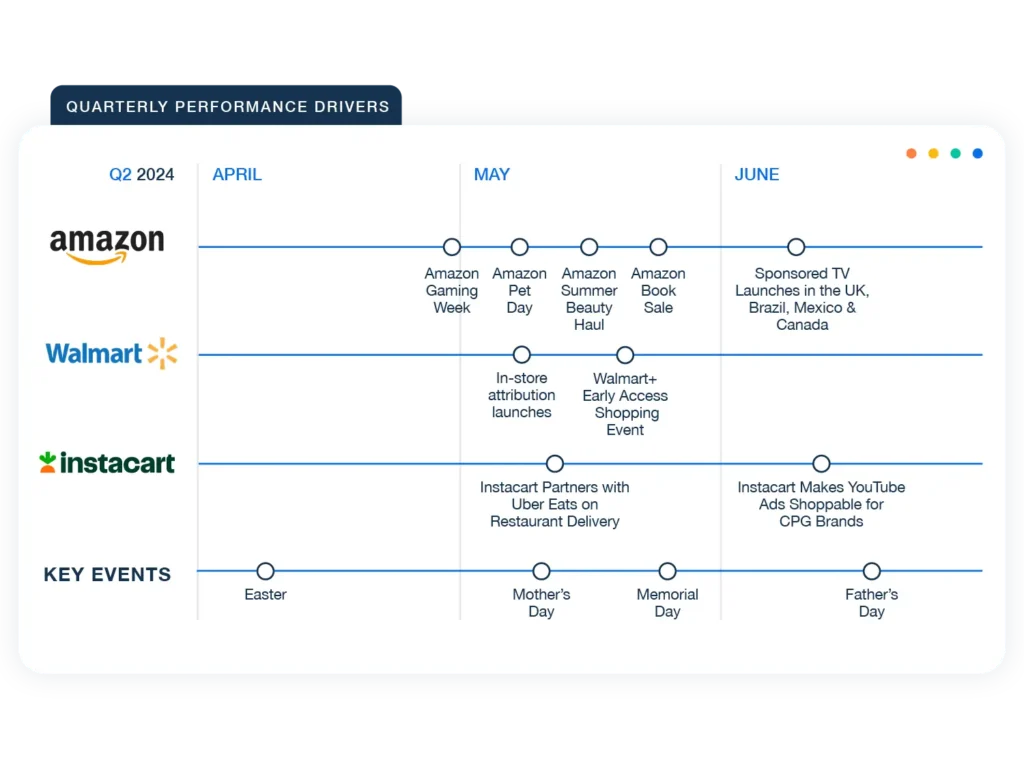

Explore Pacvue’s 2024 Q3 Benchmark Report. This report provides an expansive overview of advertising data spanning the last five quarters on a broad scale. Drawing on insights gathered from thousands of advertisers utilizing Pacvue’s platform and representing diverse brand sizes and product categories such as Pet Food and Supplies, Beauty and Personal Care, and Electronics, it stands out as one of the most comprehensive reports available in the industry. With in-depth data and benchmarks provided, this report equips you with the necessary tools to evaluate your performance and gain insight into the latest industry trends. Some of the top highlights from Q2 include Amazon’s new Sponsored TV ads, Walmart’s in-store attribution, and Instacart’s shoppable ads on YouTube.

Quarterly Performance Drivers Calendar

“What we’ve seen so far this year is that AI has enabled businesses of every size to achieve a new level of scale and speed. This is good news, considering how many new kinds of retail networks and ad formats have emerged. More innovation means more opportunity – as long as advertisers know where to look and how to adapt.”

Q2 Insights from Industry Experts

“Search, whether on or off the retailer’s site, is being increasingly augmented by AI that starts with solutions, rather than expecting the shopper to already have those solutions in mind. While I don’t expect the weekly purchase journey for milk or eggs to shift seismically, higher consideration journeys, especially gifting, will have changes. I think we’ll see a range of different shopping behaviors this holiday as a result.”

“Retail Media offers a wealth of opportunities for brands and agencies alike. The key is to ensure you are not trying to ‘boil the ocean’ and have a clear, prioritized roadmap. For brands, retail media can offer incremental revenue streams and more data solutions. On the other hand, agencies can develop more personalized campaigns, create a seamless customer experience, and even join up on and offline media.”

“The three major opportunities I see in today’s retail media space are the use of AI, data clean rooms, such as Amazon Marketing Cloud (AMC), and the simplified access to TV ads. At Cannes Lions, Amazon presented its AI tool for advertisers, reducing the creative effort by 90% and making creatives accessible to all companies. is getting stronger by the day and more and more user-friendly. TV ads are now available for every brand with Sponsored TV Ads. This is a game changer for SMBs and will disrupt the market of TV ads with a new offer that is incredibly efficient.”

“The biggest opportunities for eCommerce success lie in the actual attribution of sales to advertising types that traditionally lacked them. For instance, you can now get real sales attribution from streaming TV ads. The ability to measure—and not just estimate—is the most valuable aspect of retail media, especially as it moves up-funnel with larger retailers that have other media outlets, like Prime Video. You can run upper-funnel ads on inventory from HBO Max using Amazon DSP, which means you can truly see the TV attribution.”