It’s been a record-breaking year for the adtech industry. From Google’s pivot on third-party cookies in the summer to the rapid release of AI-powered advertising solutions, we’re seeing innovation at a rate like never before.

Around this time last year, we were busy analyzing early trends in the lead-up to Cyber 5, which we later published in our Cyber 5 2023 Benchmark Report and our Q4 2023 Benchmark Report. In our reports, we highlighted the changes generative AI produced, discovering that users were making holiday-related purchases earlier than ever, likely due to Amazon kicking off the holiday shopping season in early October with Prime Big Deal Days.

This year, we’ve been looking hard at all the numbers from last year to see what we can expect as we enter the prime holiday season.

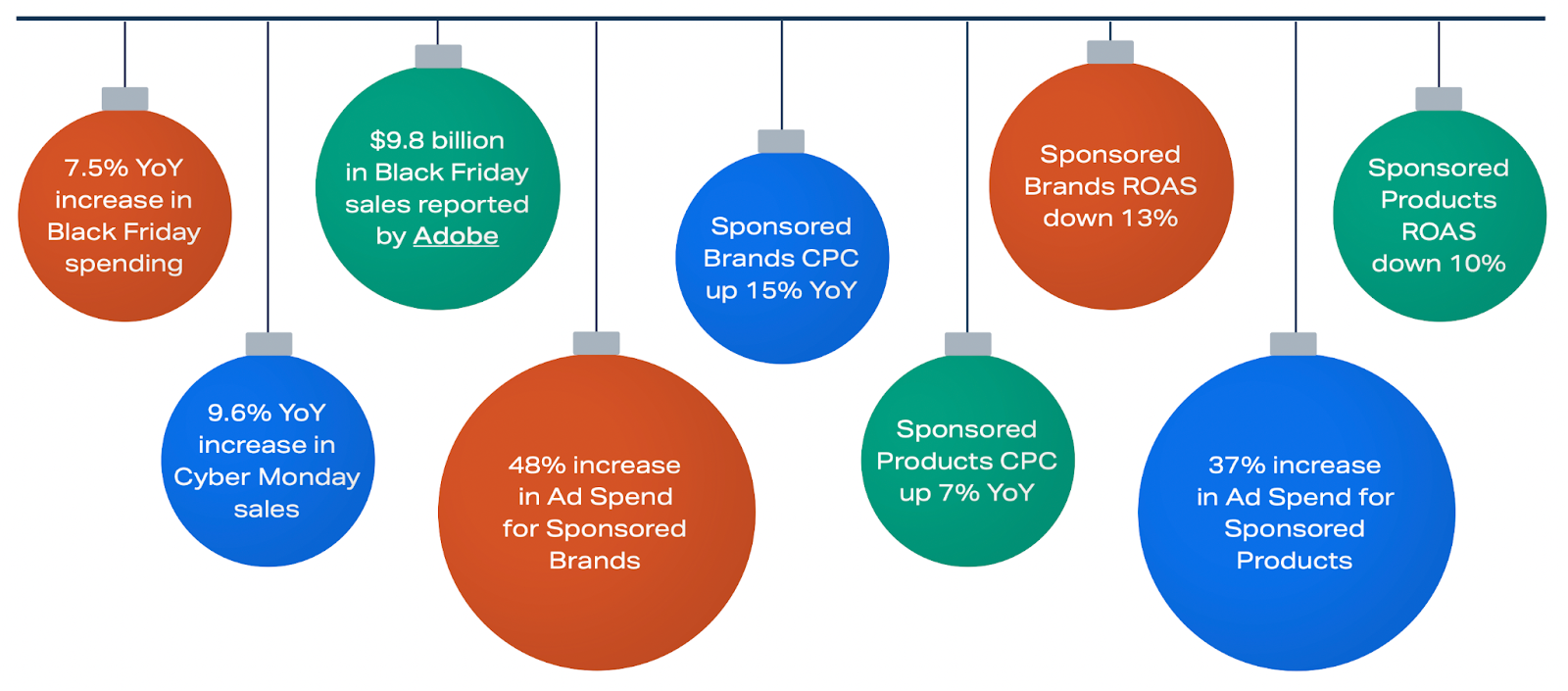

Here’s what we found from the November holiday period, “Cyber 5,” last year:

Here are our top predictions:

CPC Keeps Going Up

Last year in Q4 2024, we saw an overall 11.7% increase in CPC for Amazon Sponsored Products and an 8.2% increase for Amazon Sponsored Brands. But, when we zoomed into the costs during the Cyber Five sales period, we saw a 30% increase in CPC for Sponsored Products from Cyber Five 2022 to Cyber Five 2023.

We expect that trend to continue. This year, we’ve seen a steady increase in CPC during big sales events. On Amazon Prime Day 2024, Pacvue measured a 7.6% increase in CPC compared to 2023. The competition on Amazon is getting more sophisticated and tactical, which means the prices for the most popular ad units continue to rise.

What Advertisers Should Do: Keep a close eye on your ad budget as you start to spend during the holidays. This will ensure that you can increase spend throughout the sales periods as CPCs may increase more than expected and drive the competition to scale back. Monitor trends in real time to see where you might find new opportunities.

Pacvue tip: To strategically plan your budget across retailers this holiday season, use Pacvue’s newly released Retail Media Budget Planner to easily spot spending issues, forecast ROI, and use AI-driven optimizations for cross-platform budget recommendations.

The Halo Effect Gets Bigger than Ever

The “halo” effect from ad campaigns during holiday tentpole events, like Cyber 5, is all about the time before and after the specific sales period. A lot of consumers will start researching products days ahead of time to know what they want to buy when things go on sale. Alternatively, the audiences you reach before, during, and after Cyber 5 that don’t buy initially might end up buying later.

At Pacvue, we call this the lead-in and lead-out strategy. By setting daily budgets and bidding strategies, you can ensure that your products start winning top placements before the event starts to start winning share. With Category Intelligence from Pacvue, you can even monitor the competition to understand when other brands start to ramp up spend and when you should reach customers.

What Advertisers Should Do: Make sure to explore Amazon DSP ads to ensure that you have a strategy in place that goes beyond Sponsored Product and Sponsored Brand ads. With Amazon’s DSP ads, you can reach audiences beyond the Amazon ecosystem and even combine your own customer data with Amazon data to personalize the ads based on where the customer is on the buying journey.

Incremental Return on Ad Spend Takes Center Stage

During Cyber Five 2023, Pacvue data shows that return on ad spend on Amazon dropped by 34% year-over-year for Sponsored Products ads on Black Friday and 27% year-over-year for Sponsored Brands ads.

More competition in the retail media landscape significantly impacts overall ROAS. And when you’re managing ad strategies across multiple retail media networks, it can be harder to track what’s actually working to drive the bottom line. That’s why Pacvue released our new incremental return on ads spend (iROAS) console in September: to help advertisers figure out the best ways to spend their ad budgets.

By connecting the different RMNs and showing, at a high level, which ad formats and which environments are driving incremental revenue, advertisers can better optimize their ad strategies in real-time and in the future during the holiday period.

What Advertisers Should Do: While ROAS is a key guiding metric for campaign success, you should keep iROAS in mind as the holy grail of measurement. This is ultimately the metric that shows how you drove net new sales from your ad campaigns that wouldn’t have occurred without the ad exposure.

Advertisers Put a New Emphasis on New-to-Brand (NTB) Customers

The other side of the iROAS conversation is all about customer acquisition. If a customer is already starting a search with a specific brand name or product, then a Sponsored Products brand term targeting ad isn’t driving any real new business. To really expand your brand’s footprint, you have to start thinking about targeting NTB customers, instead.

But how can you make sure you’re reaching net new customers? Amazon has started making it easier to identify the right audience with AMC data. By exploring ideal customer profiles and understanding who hasn’t historically made a purchase from your brand, you can create new ad campaigns to specifically target those shoppers.

What Advertisers Should Do: Make sure you’re up to date with all the new features from AMC and think about what might resonate with new customers before Cyber 5. Rather than just discounts and deals, identify which messaging and creatives would work best and measure the results across different formats.

Understand the Different Retail Media Networks

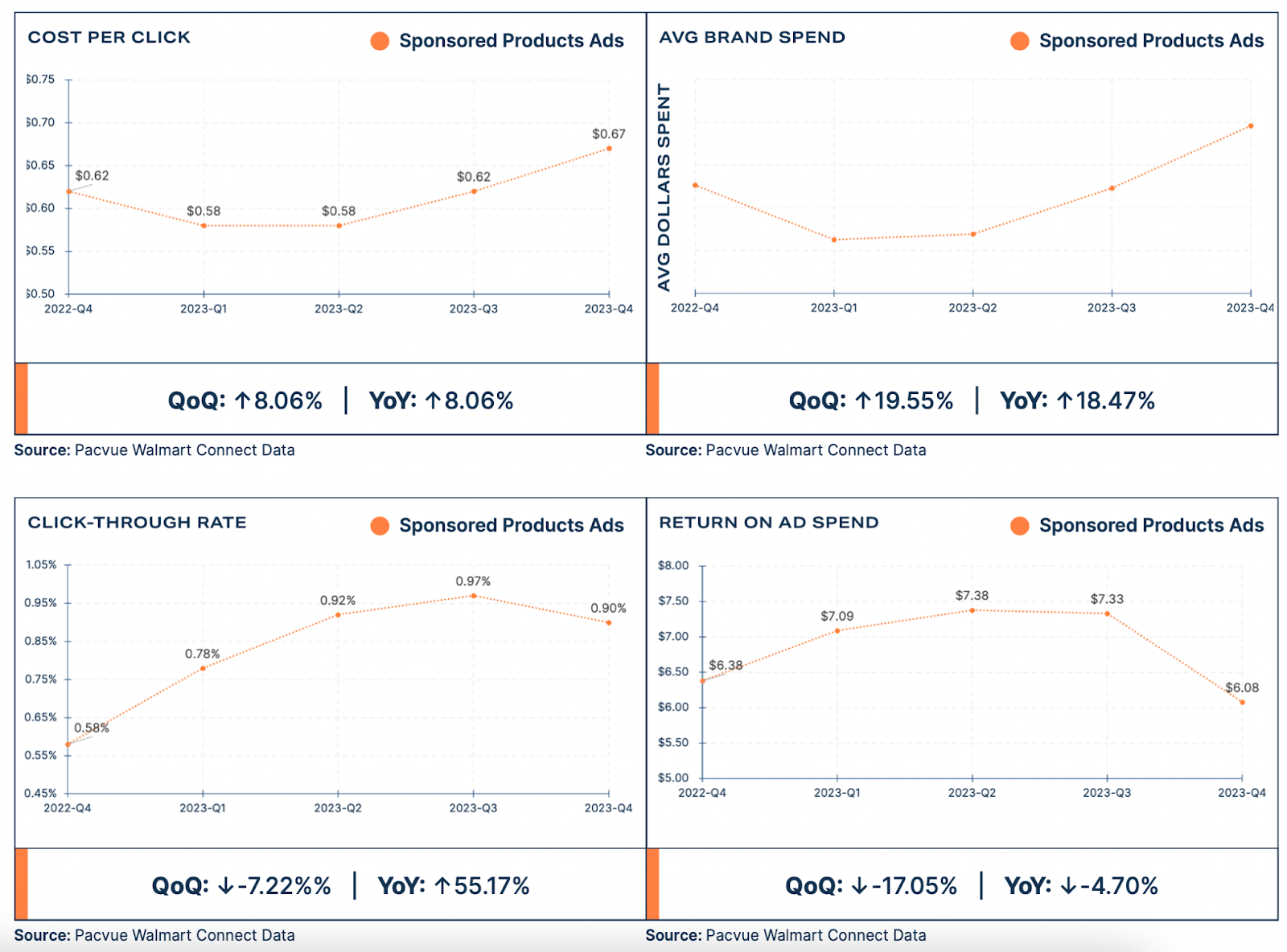

Pacvue analyzed the data from Amazon, Walmart, and Instacart to get a full picture of costs CPC, CVR, brand ad spend, and other data. Here’s what we found last year when we looked at overall Q3 2023 compared to Q4 2023 data, and what trends you can expect to see this year:

Amazon

Walmart

Instacart

What Advertisers Can Do: Investigate the potential of different retail media networks where it might make sense for your audience. There might be some hidden opportunities that you can use at the last minute with extra budget – especially when it comes to smaller RMNs with specific audiences.

Making the Most of Holiday Season 2024

So, how can you keep optimizing across the holiday season?

Pacvue recommends four different tactics:

- Use AMC Insights and Lookalike Audiences to make sure you’re creating customer segments that are most likely to be interested in your products – and customers who haven’t previously bought from your brand.

- Think about dayparting when it comes to your budget. CPC prices are constantly fluctuating during busy sales periods. There are hidden pockets of opportunity where you can get a lot more return on ad spend by investing in times that aren’t as competitive.

- Plan ahead, but be ready to pivot. It’s hard to predict shopper behavior across the retail media ecosystem, so monitor trends closely to make sure you’re ready to adapt as needed.

- Make sure to understand your digital shelf presence. Improve your product pages and constantly monitor reviews to keep tabs on different promotions.

Want to learn more? Check out Pacvue’s Holiday Headquarters 2024!