Pacvue 2024 Q3 Retail Media Benchmark Report

Interactive Explorer

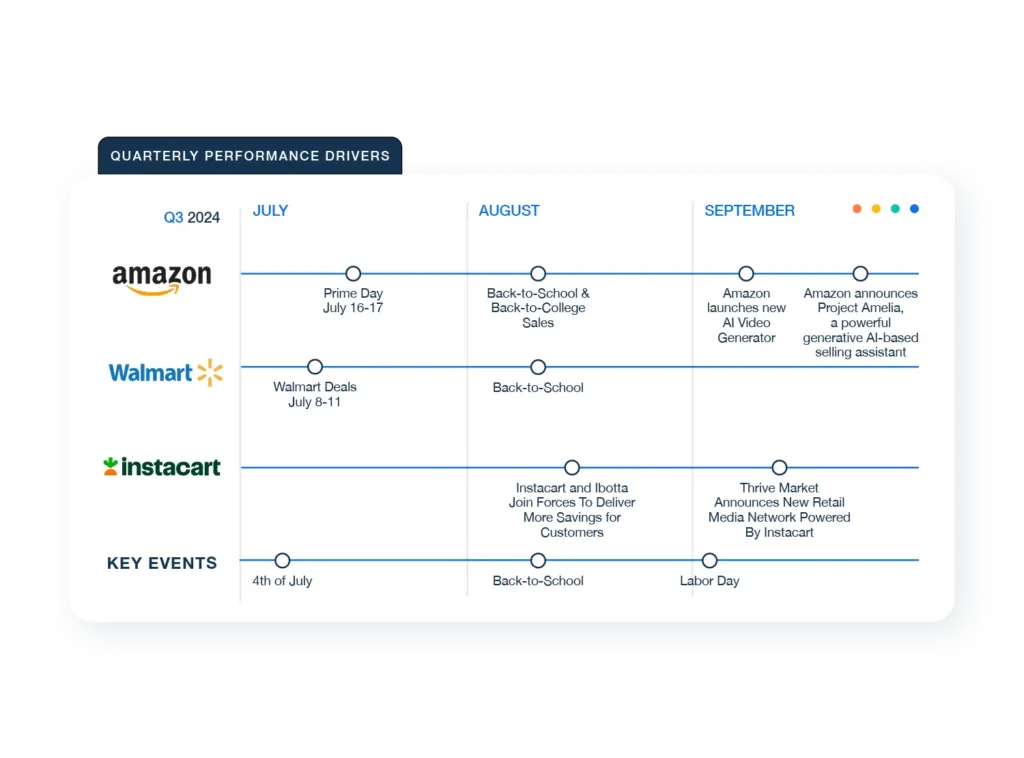

Explore Pacvue’s 2024 Q3 Benchmark Report. This report provides an expansive overview of advertising data spanning the last five quarters on a broad scale. Drawing on insights gathered from thousands of advertisers utilizing Pacvue’s platform and representing diverse brand sizes and product categories such as Pet Food and Supplies, Beauty and Personal Care, and Electronics, it stands out as one of the most comprehensive reports available in the industry. With in-depth data and benchmarks provided, this report equips you with the necessary tools to evaluate your performance and gain insight into the latest industry trends. Some of the top highlights from Q3 include Amazon’s new AI video Generator, Walmart’s category expansion, and Instacart’s new partnerships

Quarterly Performance Drivers Calendar

“We noted a lot of increased competition across the board during Prime Day as sellers invested more ad budget into retail media channels. That made things more expensive: our data showed that advertisers spent 27% more year-over-year during the week of Prime Day as overall CPC costs got significantly higher in most categories. Higher ad costs can be caused by a lot of different things: industry dynamics, consumer behavior, increased competition, a changing share of market, customer loyalty and changing product demands.”

Q3 Insights from Industry Experts

“The question is no longer whether to invest in retail media, but how to do so to drive incremental sales growth. As retail media budgets expand and offerings become increasingly sophisticated, it is imperative to assess which investments deliver the highest incremental lift on overall retailer sales. Incrementality measurement is a crucial practice for every brand, ensuring that each media dollar is optimized to drive measurable, long-term growth across the business.”

“One of the biggest opportunities right now is the fact that there are so many more metrics available to measure success of our campaigns now. We are so close to being able to directly tie objectives to KPIs, to mid-campaign optimization metrics. It’s making our media campaigns more strategic and multifaceted.”

“Looking outside of Amazon is the biggest opportunity for brands in late 2024 and beyond. Amazon has done and will always lead the way in retail media, but in EMEA the Tesco Media and Insight Platform has made some big hires and is scaling rapidly. Platforms such as Zitcha are making it easier for retailers to capitalise on the retail media boom – they recently signed a deal with Ocado Ads and secured a $15m Series A. It will be exciting to see how these platforms can work together to encourage more spend and connect to other marketing channels and formats.”

“The CPG industry needs to shift from ‘Digital Penetration’ as the benchmark for how many dollars are allocated to retail media, to ‘Digital Share of Growth.’ For example, of the total growth of my company in 2025, how much of it will come from online channels? If online channels are projected to be 60% of your growth in 2025, you should consider allocating 60% of your marketing budget growth to digital/retail media channels.”

![Walmart Connect Ads Guide: Why Your Brands Should Be Investing in Walmart Retail Media [2025]](https://pacvue.com/app/uploads/2024/10/Blog-Cover_Walmart-Connect-Ads-Guide-2025-scaled.webp)