Amazon Prime Day 2024 has come and gone. The verdict is in: this was Amazon’s biggest sales period yet. Compared to last year, Prime Day 2024 sales grew by 11% and reached $14.2 billion in total retail sales, according to Adobe. The product categories with the most sales, according to Adobe, were consumer electronics and back-to-school products. Amazon’s recently debuted AI assistant, Rufus, helped millions of shoppers with personalized recommendations.

But what did this mean for ad spend? Pacvue has crunched the initial data to highlight trends around cost-per-click (CPC), conversion rate (CVR), and more as a way to understand the shopping environment. Here are our five key takeaways for advertisers from Prime Day 2024:

1. Ad Spend Peaked Before and After Work

- When were shoppers at their busiest?

- On Day 1, ad clicks peaked around 7am and 6pm. The highest average CPC was 7am, showing that shoppers were eager to get started early.

- On Day 2, ad clicks peaked around 6pm and sales peaked at 8pm, showing the final wave of shoppers eager to get their final deals before Prime Day ended and lower competition toward the end of the sales period.

2. Sales are Lower on Day 2.

- Day 2 of Prime Day seemed significantly less busy but more strategic. Pacvue data showed:

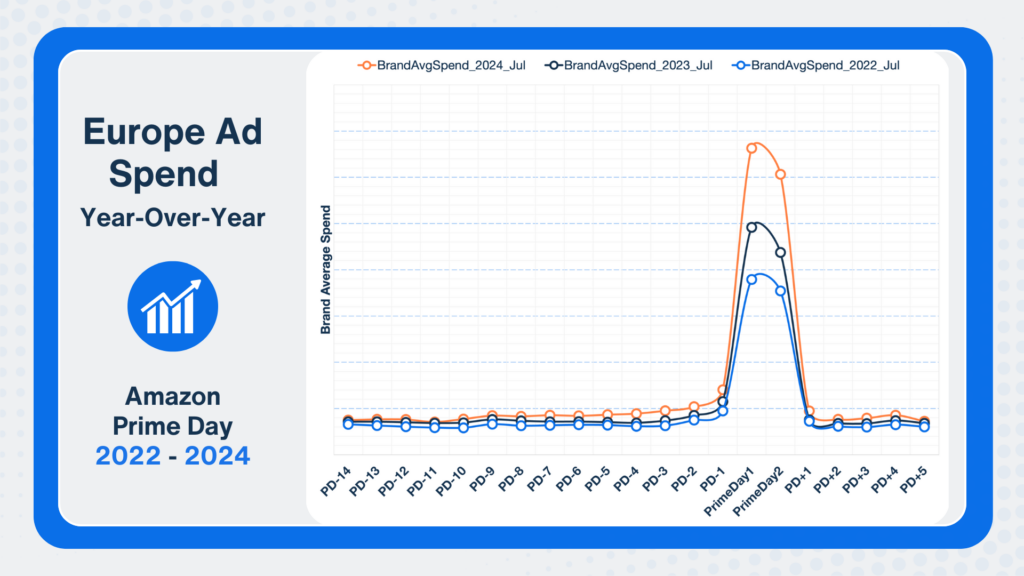

- Average spend across SP, SB and SD on Day 2, saw a 20% decrease in the US and 10% in the EU, compared to Day 1.

- CPC increased by 4% in the US and 11% in the EU mainly due to the increase in CPC for Sponsored Product Ads on Day 2 – indicating competition was still very intense on the second day.

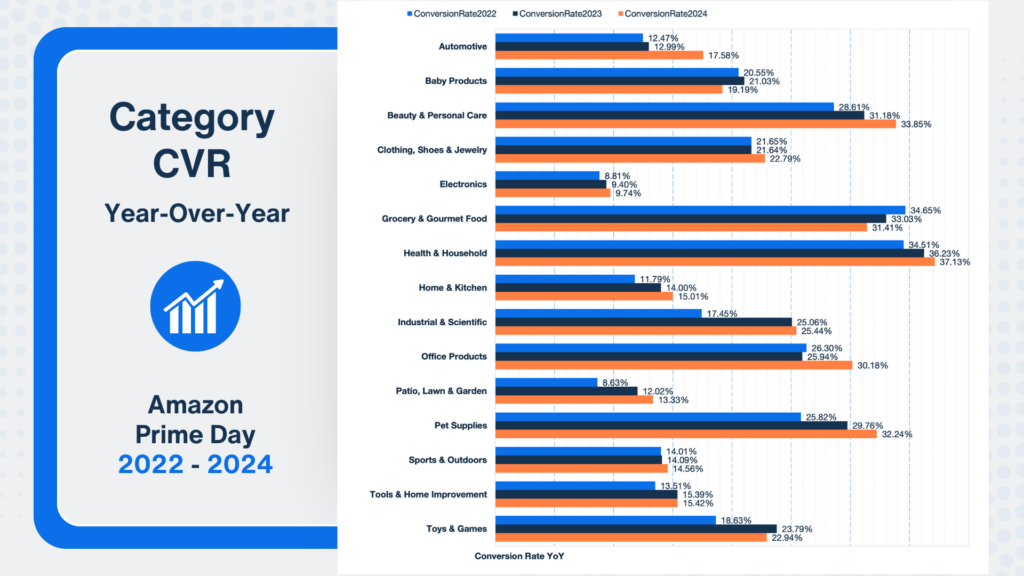

3. Category Growth by the Numbers

Brand spend rose across the board during Prime Day – unless you were in the Automotive or Tools & Home Improvement category, where numbers stayed relatively flat. Here are the product category highlights from our Prime Day data:

Day 1

- Toys & Games and Clothing, Shoes & Jewelry had the highest WoW CVR growth, reaching 22% and 17%, respectively.

- Electronics had the highest week-over-week growth in both Average Spend and Average Sales.

- Baby Products had the highest average spend overall.

Day 2

- Toys & Games had the highest Average Spend growth rate, reaching 167%.

- Average Sales increased except for Tools & Home Improvement, and Beauty & Personal Care.

- Office Products saw the highest increase in Average Sales, reaching 136%.

Prime Day 2024 vs Prime Day 2024

- Toys & Games saw +31% higher CPC.

- Automotive saw +25% higher CVR.

- Industrial & Science saw +47.25% higher CPC.

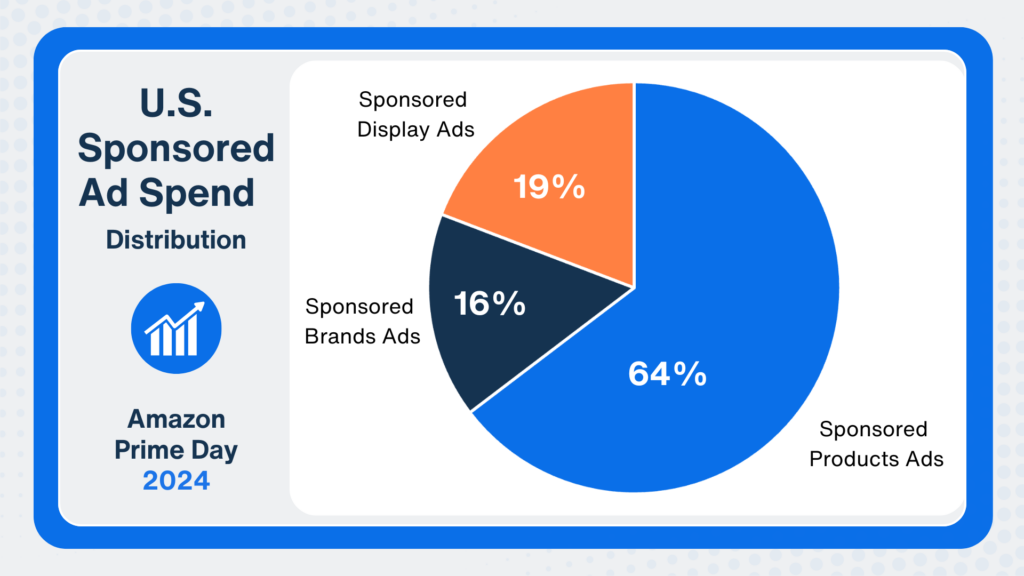

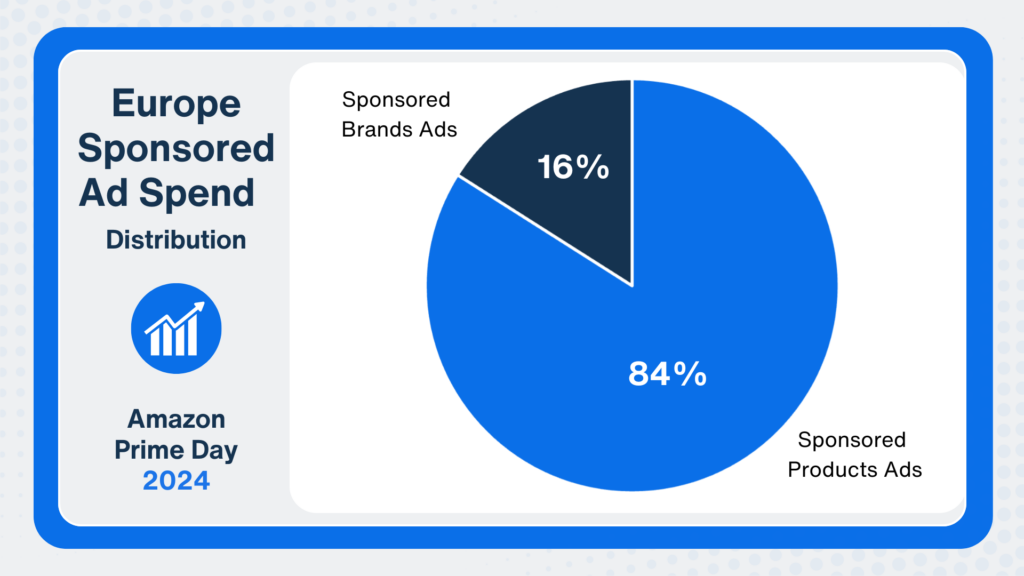

4. Sponsored Products Ads were by Far the Most Popular Ad Format

If you upped your investment in Sponsored Products Ads during Prime Day 2024, you weren’t alone. Our Pacvue data showed that the average daily spend distribution in the US looked like this:

- 64% – Sponsored Products Ads

- 16% – Sponsored Brands

- 19% – Sponsored Display Ads

Spend distribution in the EU was as follows:

- 84% Sponsored Products Ads

- 16% Sponsored Brands

Does this reflect a bias in the media mix to what’s most likely to get noticed? Or do most brands have the data to back up the investment strategy?

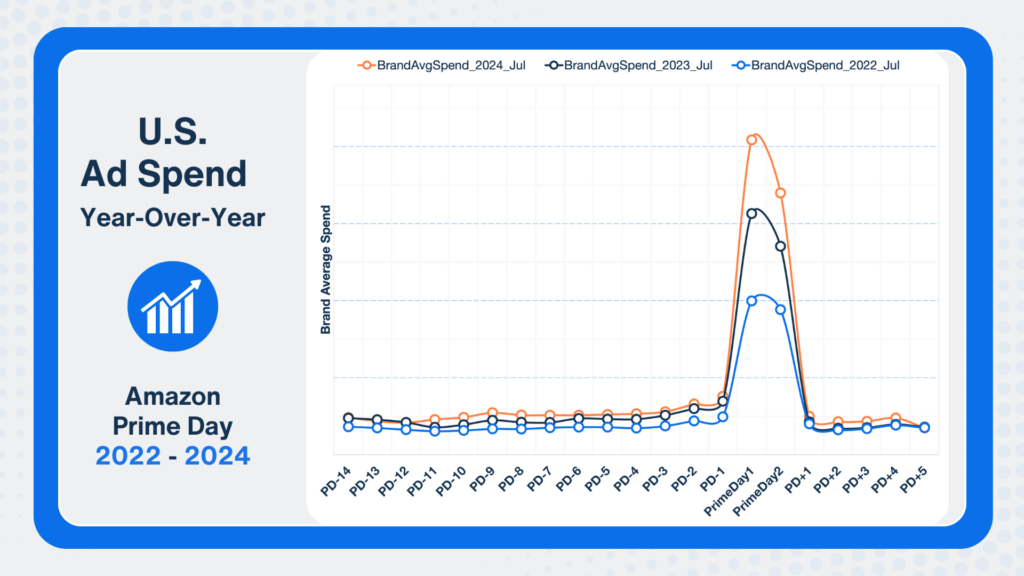

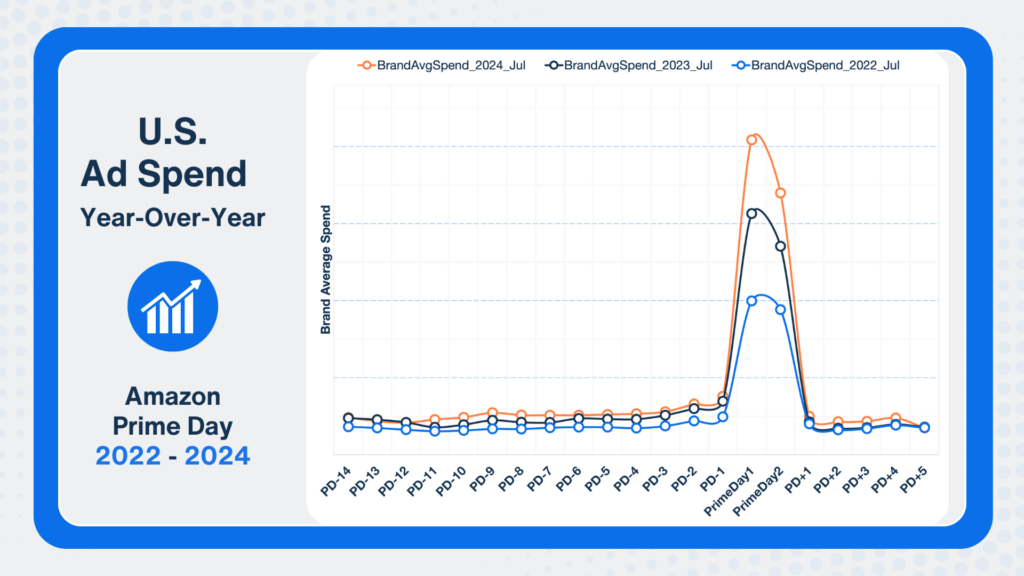

Optimization Prime: Taking advantage of post-Prime Day

On Day 1 of Prime Day, Pacvue saw an unprecedented surge of activity. Daily spend rose by 27% as advertisers worked to get their deals in front of the right people. This indicates that merchants allocated more advertising budgets to Prime Day 2024 than last year, but also shows that market competition has intensified.

Here’s the good news: even if you lost out on top spots to the competition, you can have a customer lifecycle strategy that keeps all those new audiences coming back. For the rest of the summer, advertisers should make sure that they’re continuing to reach out to all the incremental audiences and new customers that they acquired during the week. This has been proven to drive additional value over the summer and offers a great pathway to the holiday season. Here are our top 5 tips to take advantage of the Post-Prime Day hype:

- Analyze your Prime Day performance data to identify top-performing campaigns and flag any anomalies or errors. The best part is that you can now ask Pacvue Copilot to do it for you. Learn more about Copilot and what it can do here.

- Assess and adjust your inventory levels based on Prime Day sales data. This includes planning for restocking high-demand items and managing overstocked products through targeted promotions.

- Monitor and adjust advertising budgets in the days that follow, considering that CPCs will be cheaper post-event, but shoppers are still browsing for products.

- Re-engage audiences with Amazon Marketing Cloud. Utilize AMC to create audiences you can retarget with DSP ads to convert shoppers who did not purchase. Learn best practices and strategies here.

- Prepare for future sales events. Back to school is up next and Cyber-5 will be here before you can say turkey. Now is the best time to start planning your campaigns. Check out our 2024 Back to School Guide with tips for Amazon, Walmart and Target.

We hope you had a great Prime Day 2024. Now, let’s get ready for the back-to-school rush!