The United Kingdom is a prominent player in the global eCommerce landscape, due to a population of over 67 million and an advanced digital infrastructure. With consumers increasingly turning to online platforms, the UK eCommerce market presents significant opportunities for brands and agencies aiming to grow their online presence. This article will delve into the key trends, challenges, and opportunities shaping the UK’s eCommerce sector, along with how platforms like Pacvue can help businesses excel in this highly competitive market.

Key Trends in the UK eCommerce Marketplace

The UK eCommerce market has seen consistent growth over the past decade. The UK’s B2C eCommerce market is projected to reach US$129.70bn in 2024. This expansion is driven by high internet penetration, strong consumer trust in digital transactions, and a preference for online shopping. As a leading eCommerce market in Europe, the UK presents a lucrative space for global and domestic brands alike.

Popular Product Categories

Among the most popular product categories in the UK are fashion, electronics, home and garden products, health and beauty, and groceries. Online grocery shopping has gained traction due to the pandemic, with consumers increasingly opting for the convenience of home delivery or click-and-collect services. Platforms such as Tesco, Sainsbury’s, and Ocado have benefitted from this surge.

Amazon’s Dominance in the UK

Amazon plays a dominant role in the UK eCommerce market, accounting for nearly one-third of all online sales. Currently, the country is Amazon’s second-biggest market in Europe after Germany. It’s wide product range, customer trust, and efficient logistics have made it the go-to platform for many UK consumers. For brands, maintaining a presence on Amazon is crucial for reaching a broad UK audience.

Benchmark Data (Amazon Performance 2023 vs 2022)

- In 2023, Amazon’s average spend in the UK saw an increase in growth of approximately 13% year-over-year highlighting positive growth in overall activity and investment in the market.

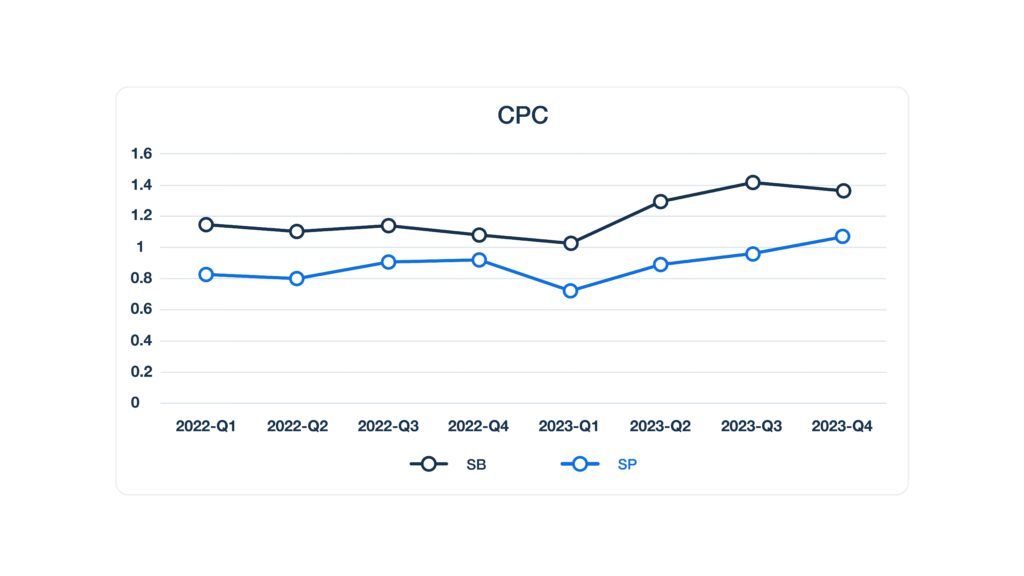

- Similarly, the average cost-per-click (CPC) on Amazon in the UK also saw a rise from $0.97 in 2022 to $1.08 in 2023, a 11.34% YoY increase. This suggests that competition for ad placements intensified during this period, increasing the price advertisers paid.

- In contrast, the average click-through rate (CTR) experienced a slight decline, dropping from 0.39% in 2022 to 0.34% in 2023.

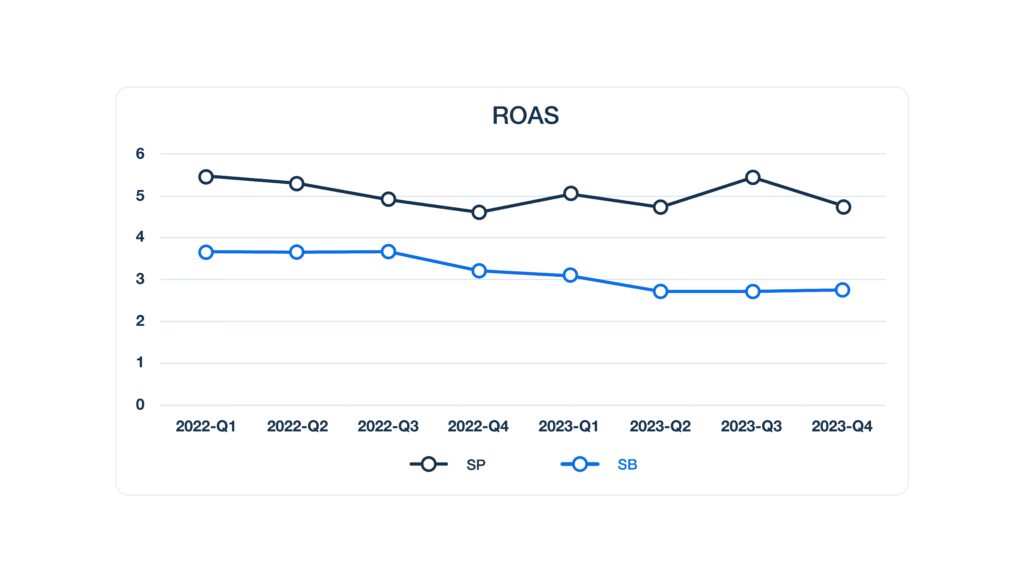

- With the increase in CPC and decline in CTR, the average return on ad spend (ROAS) also dropped slightly from $4.33 in 2022 to $3.96 in 2023. This decrease of 8.5% suggests that Amazon ads in the UK become less efficient during this period, generating less revenue for each dollar spent.

- Lastly, the average conversion rate (CVR) increased from 17.31% in 2022 to 18.23% in 2023, a significant improvement of approximately 5.2%. This increase indicates that a higher proportion of clicks on Amazon ads are leading to actual sales, suggesting that the overall quality of traffic has improved YoY.

Retail Media Growth

Retail media networks are on the rise in the UK, offering new avenues for brands to engage with consumers. Platforms like Amazon and eBay provide brands with tools to create targeted ads and sponsored product listings. Retail media presents an opportunity to increase visibility, boost sales, and improve brand loyalty, especially in a competitive environment.

“The UK remains a beacon for eCommerce innovation, driven by a tech-savvy population and a robust digital infrastructure. However, the most advanced brands and agencies are leveraging newer retail media technologies including Amazon Marketing Cloud, Sponsored TV placements and rich data sets including the 23m Tesco Clubcard holders and 16m+ Nectar users to really get an understanding on first party data. Hopefully 2025 will see platforms help brands and agencies use this data to fuel even better results. I am excited to watch it unfold”

– Matt West, Founder at Boostkit

Localization and Cultural Relevance

To succeed in the UK market, businesses must adapt to local preferences. Customizing product offerings, marketing strategies, and customer service to match UK consumer behaviours is key. For example, ensuring that pricing reflects local currency and understanding the UK’s promotional calendar (such as Black Friday or the January sales) can significantly enhance a brand’s appeal.

AI and Automation

AI and automation are becoming vital tools in the UK eCommerce space, helping businesses optimize everything from marketing campaigns to customer service. AI-powered solutions such as personalized recommendations and automated chatbots are enhancing the customer experience, while back-end AI-driven analytics are improving decision-making and operational efficiency.

Challenges in the UK eCommerce Market

While the UK offers ample opportunities, businesses must also navigate a range of challenges to succeed.

- Regulatory Landscape: The UK has robust regulations governing eCommerce, particularly around data privacy and consumer rights. Following Brexit, the UK adopted its own version of the General Data Protection Regulation (GDPR), known as the UK GDPR. Businesses operating in the UK must ensure compliance with these data protection rules, especially when handling consumer data across borders. Furthermore, adherence to VAT regulations, distance selling rules, and the Consumer Rights Act is essential to operate legally and effectively.

- Heightened Competition: The UK’s flourishing eCommerce sector means that competition is fierce, with both local and international brands vying for market share. To stand out, companies need to invest in strong branding, localization, and innovative digital marketing strategies. Price sensitivity and free delivery expectations are also significant factors influencing consumer behaviour in the UK.

How Pacvue Supports Brands in the UK

Pacvue offers a comprehensive suite of tools designed to help brands succeed in the competitive UK eCommerce market. With a focus on AI-powered insights and data analytics, Pacvue enables brands to make data-driven decisions and optimize their online presence.

- Pacvue AI and Data Insights: Pacvue’s AI-powered platform provides brands with real-time data and actionable insights, allowing them to track performance, identify trends, and adjust strategies to stay ahead of competitors. Pacvue’s tools, such as keyword research and bid optimization, are particularly valuable for maximizing advertising ROI on platforms like Amazon.

- Pacvue Revenue Recovery: Pacvue’s Revenue Recovery service automates invoice reconciliation and dispute management, helping brands on Amazon UK reduce profit loss. By addressing Co-op discrepancies, price claims, invoice shortages, and chargebacks, Pacvue’s AI-driven tool improves financial efficiency in the UK’s fast-paced eCommerce market.

- Tailored Solutions for the UK Market: Recognizing the specific needs of UK consumers, Pacvue provides localized solutions, helping brands optimize their product listings, manage ad campaigns, and navigate regulatory requirements. Whether it’s enhancing search visibility or developing effective marketing strategies, Pacvue empowers brands to succeed in the UK.

Conclusion

The UK eCommerce market is both highly competitive and filled with potential. As consumer demand for online shopping grows, brands that leverage retail media, localization, and AI-driven tools will be best positioned for success. By partnering with platforms like Pacvue, brands can navigate the complexities of the UK market and achieve long-term growth.

Learn More

Interested in optimizing your eCommerce strategy for the UK market? Contact Pacvue today to discover how we can help your brand thrive in one of Europe’s most dynamic digital landscapes.