Q4 2024 Retail Media Benchmark Report

How did you stack up against the competition in Q4?

Explore Pacvue’s 2024 Q4 Benchmark Report. This report provides an expansive overview of advertising data spanning the last five quarters on a broad scale. Drawing on insights gathered from thousands of advertisers utilizing Pacvue’s platform and representing diverse brand sizes and product categories such as Home and Kitchen, Beauty and Personal Care, and Electronics, it stands out as one of the most comprehensive reports available in the industry. With in-depth data and benchmarks provided, this report equips you with the necessary tools to evaluate your performance and gain insight into the latest industry trends.

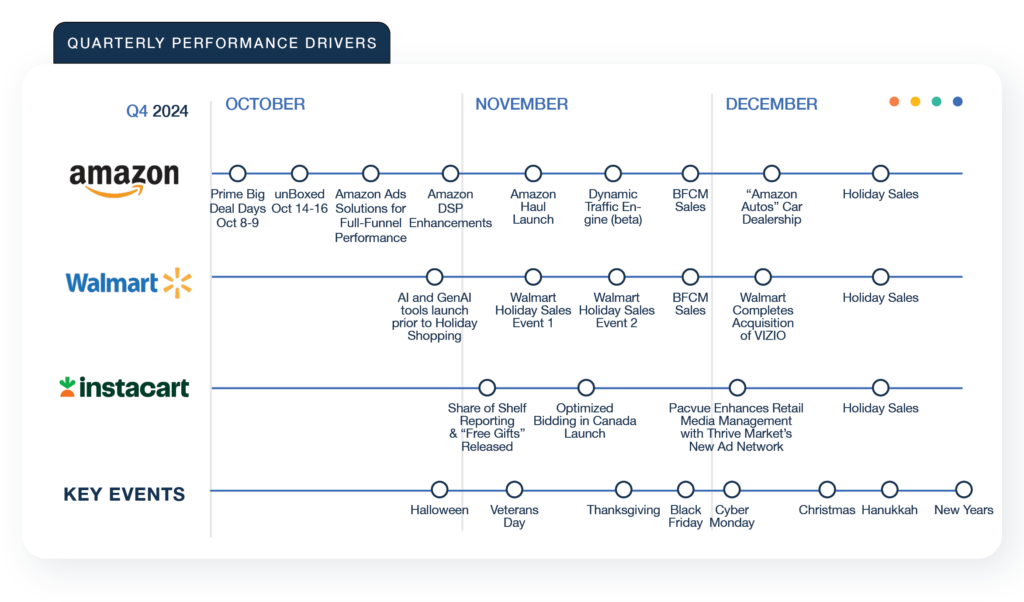

Quarterly Performance Drivers Calendar

“In our Q4 2024 Benchmark Report, we look back on the numbers behind the holiday season across the Amazon, Walmart, and Instacart retail media ecosystem. By diving into quarterly and annual performance metrics, we’ll take a close look at the way that both customer behavior and retail media pricing are changing.”

Q4 Insights from Pacvue Experts

“The first step to building a successful omnichannel retail media strategy is to be clear on what your goals are and how your activities will help you reach them. The second step is to have a measurement solution that gives you a 360-degree view. The more focused your efforts are across all mediums, the more often you’ll reach high-value shoppers.”

“The future of data is consolidation and recommendations. If you can bring all the disparate data together and connect the dots, then it’s easier to see what will drive performance. And it’s easier for the platform itself to identify the best opportunities going forward.”

“Discounts are constant, and we know consumers are feeling overwhelmed. 74% of shoppers have abandoned a shopping cart in the last three months. With this, brands seeing success are advertising beyond the noise of onsite SERPs and winning across the web, on streaming, and more.”

“Retailers like Instacart can specifically target new customers to their platform with their display offerings, helping broaden brand awareness across all categories. Since we tend to see an increased volume of new entry across retailers during the holiday period and new year, these retargeting tactics are a great way to capture those customers.”